Streamers: Striking & Hiking

Last weekend I had a Tour De France binge-watching session. Yes, I’m one of the only people I know that watches it. Yes, I know you typically don’t say you binged a sporting event, but… it’s a 21 day race and I save up multiple days in a row to watch on YouTubeTV, ok!? Sue me!

Anyhow... I’m binge-watching this race, scrolling through news on my phone, and generally having a good time. Then I see this story about Peacock raising their prices. No biggie – not a subscriber. But I remember seeing other price increases for streamers when I was writing a post about Netflix. So I get curious and dig into it.

It turns out this is a theme. First Prime Video (Feb ’22), then Hulu (Oct ’22), then Apple TV+ (Oct ’22), then Max (Apr ’23), then Paramount+ (Jun ’23), and now Peacock.

Hang on a second. We are headed for a recession (maybe?). I don’t understand why they would be raising prices when it’s going to get tougher for consumers to pay. Why are they hiking?

While I was researching that, I inadvertantly started forming opinions about the writers and actors strike that’s going on. This article documents my train of thought.

Hiking

Being the guy who has written a lot about inflation, I latch onto that idea. They must be raising prices because of inflation. Here’s a graph of CPI since 2017, alongside average revenue per user (ARPU - a proxy for price).

Note: this data is for all US streamers.

That doesn’t seem to explain it. They’ve been raising prices all along… not just because of inflation. On to my next theory, which is that this is because of slowing user growth, right?

I guess this makes some sense. Pretend you’re a streaming exec. Your revenue is driven by your userbase and the price they pay. You don’t directly control users, but you do directly control price. If your user base is stagnating, but you want to preserve revenue, the only lever you can pull is to increase price.

So I’m sorta believing that explanation, and then I find this incredible dataset with content costs.

Good grief!

You’re a streaming exec again… and you realize revenue isn’t the problem. You can raise prices a little, and hopefully customers won’t churn too much, but you’re not worried about that right now. You’re worried about the flaming fucking dumpster fire that is your content spend.

So my next question… why are they spending so much?

Chicken & Churn

One part of why I think they’re spending so aggressively is because everyone else is. It’s that herd mentality, where you see what your competitors are doing and you feel compelled to do the same thing. I saw this all the time in consulting, where clients at Company A would say “yeah, I like that idea… but I’m curious. How does that compare to what Company B is doing?” Honestly, in a lot of situations, that’s a great approach. You can adopt best practices from your competitors and strengthen your own offering. Streamers probably see spending more on content as a way of having a better product.

But over time, that spending becomes unsustainable. I would argue that it’s approaching that level now. Streamers like Disney that have revenue from other business units can afford to spend like this. But most can’t, and they’re speeding towards a wall in an expensively written, directed, and produced game of chicken.

So you’ve already spent a ton… why not stop? Essentially, it’s a prisoner’s dilemma. If you stop spending, content-spoiled customers will churn away from you and go to your competitors. So you keep spending, hoping your competitors are more chicken than you are.

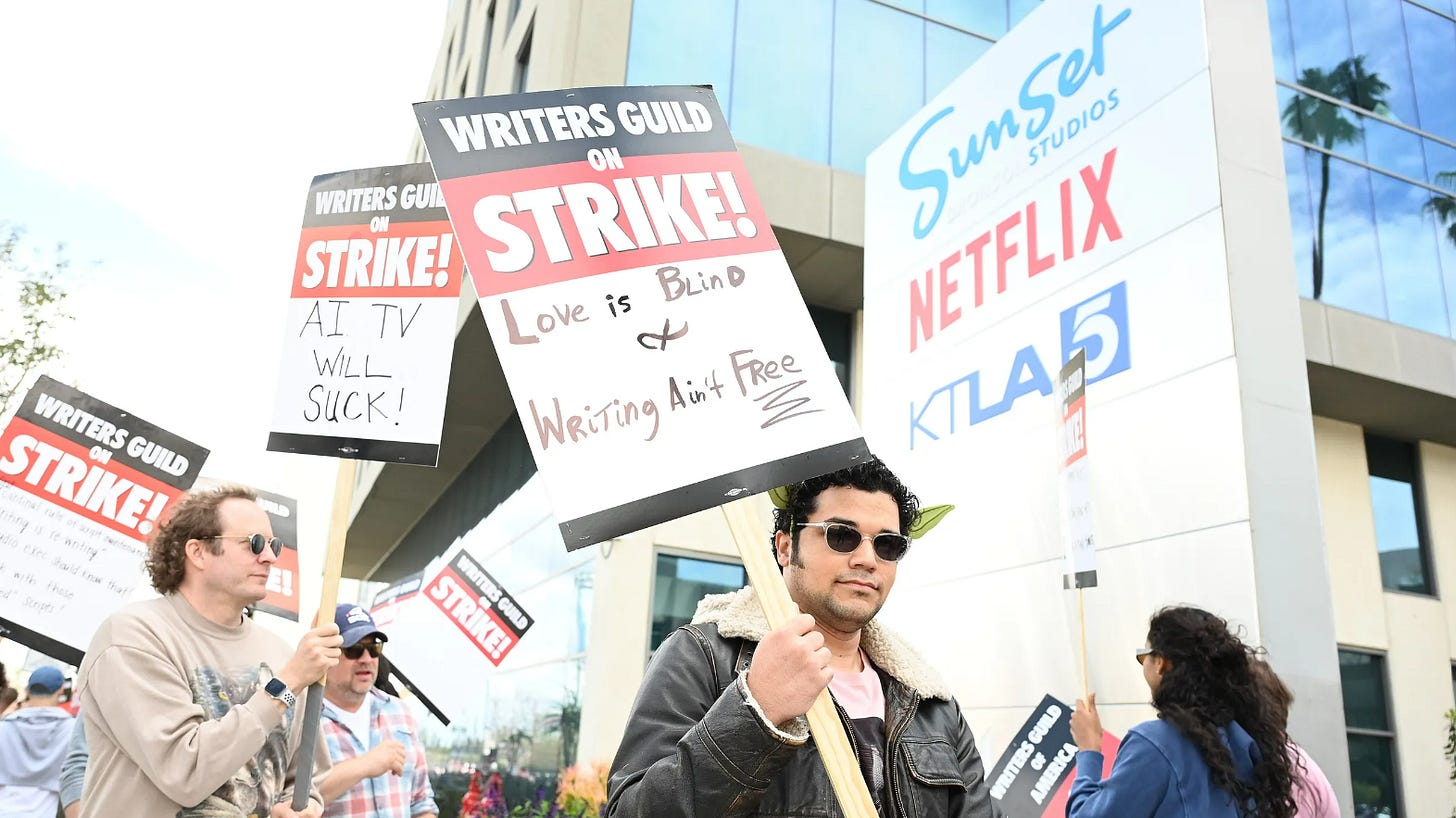

Then you hear that your writers are going on strike. There are ~20K of them. A few months later, your actors join the strike. There are ~160K of them.

When it rains it pours.

Striking

To understand why this is so critically related to the content spend, let’s think about the ways that this strike can go.

Long Stalemate: Streamers have some content on the shelf. When that runs out, they don’t have great options (market the existing library, etc.), and we will see weaker competitors exit. In this situation, the winning strategy is to ration your best “on the shelf” content, outlast your competitors, and steal their customers. Then again, maybe I’ve been watching too much of the Alone survival show.

Writers/actors win quickly: The strikers are demanding better pay/residuals and assurances that AI won’t take their jobs. If you thought content spending was a dumpster fire before, imagine spending even more for the same content. Plus, any AI cost reduction ideas are off the table.

Writers/actors lose quickly: The streamers can use AI to cut costs and don’t have to increase pay for writers/actors. Therefore, whoever is best at AI (and can keep their writers/actors happy with things other than money) will have the most efficient content spend.

As a studio executive reacting to the strike, I would be happy with #1 or #3. A long stalemate is a temporary break from the prisoner’s dilemma. It’s like we’re calling a truce amongst streamers while we battle the common enemy. Best case: some of my weaker competitors drop out, we take their customers, and we win the strike. Worst case: nobody drops out, we lose the strike, but we took a break from the spending. For #3, the best case is that we excel at AI and cut costs, making more/better content for less, so we solidify ourselves as a long-term streamer. The worse case is that we can’t do those things, so eventually we exit streaming, but we had a chance. #2 is such a painful loss – the wall we’re speeding towards will break us.

So basically, the strikers are in a tough spot. Maybe the streamers will help them save face and agree to a “compromise”, but I don’t expect any agreement to have material changes to the status quo.

Bonus Bullets

Quote of the Week:

“I don’t believe there is such a thing as laziness. Rather, I believe that most people spend their lives working on the wrong thing. No one is a lazy procrastinator in all areas of life. Everyone has something they can do effortlessly for hours. And they tend to do that effortless thing better than they do the thing they are lazy about.”

— Jeremy Giffon, General Partner at Tiny

Quick News Reactions:

Chips ACT — Euro-edition: Europe is entering the fray on chip-making, but they fell $5B short of the US’ $52B commitment last year. Weak! (I’m kidding)

Nasdaq & Crypto — Nasdaq announced they were halting plant to launch a crypto-custodian business because the “regulatory framework is changing”.

Meta’s Reality Labs — Meta is still spending on the metaverse like a bunch of drunken sailors, and I love it. They invested $3.7B in Q2.