The first time a company I knew failed, I was 9 years old. About once a week, somebody would pull up to the house in a van, jump out with plastic crates, and drop off treasure. And by treasure, I mean Dunkaroos, Goldfish, and hotdogs. It blew my (little) mind. It was only later that I learned the name of the company, and way later that I learned they were out of business. Any guesses on which company that was?

If you guessed WebVan, take a bow. It was truly an incredible company, albeit ahead of its time. And there are two takeaways everyone can learn from. First, Dunkaroos are an incredible snack and deserve to be back on shelves. This is an emotional plea, but I’m not kidding – make it happen. Second, no company lasts forever. I’m not done learning this one, but bulletproof companies get shot down all the time. Here are a few: Sports Authority (my first summer job), Toys R Us, Pier 1, Compaq, and Palm. Even amongst companies that survive, it’s hard to stay on top. According to David Blitzer, the S&P’s Chairmen of the Index Committee, “In most years, 25-30 stocks in the S&P 500 are replaced.” That means on average the S&P 500 is completely washed-out every 20 years.

To fight the trend, companies have to enter the circus – contorting themselves into new shapes, bending over backwards to serve customers, and coming up with novel acts. Today, we turn to one of those companies, a once-David-turned-Goliath that is feeling the heat.

Enter, Netflix.

The David Stage

Netflix was founded in 1997, eliminated late fees in 1999, and went public in 2002. At the time of the IPO, they had roughly 11.5K titles available, and they had grown to ~700K subscribers. Over the ensuing years, they put Blockbuster on the ropes. By 2009, Netflix had more than 10 million subscribers, and a year later, Blockbuster filed for Chapter 11 bankruptcy.

But despite early success – they knew not to rest on their laurels. Even before Blockbuster was waiving the white flag, Netflix was looking ahead. In 2007, they launched the streaming business. Things were going great with shipping DVD’s, but CEO Reed Hastings pushed to innovate. He said:

“Netflix’s DVD by mail service—which we were great at—was destined to die with the advent of broadband.”

Three years later, in 2010, he had already been proven right… streaming had surpassed DVD’s sent by mail. When you are a younger company, taking risks and jumping into new projects is easier. But this was an impressive, against-the-grain bet that paid off for Netflix.

The Latest Pressures

Over the last few years, Netflix has started to feel the heat. First, they have gotten wrapped up in the streaming wars, with everyone and their mother releasing a streaming product. Here’s a graph showing how competitors have exploded onto the scene:

Increased competition means that over time, customers might become more sensitive to price increases, or might unsubscribe entirely because they like competitor content better.

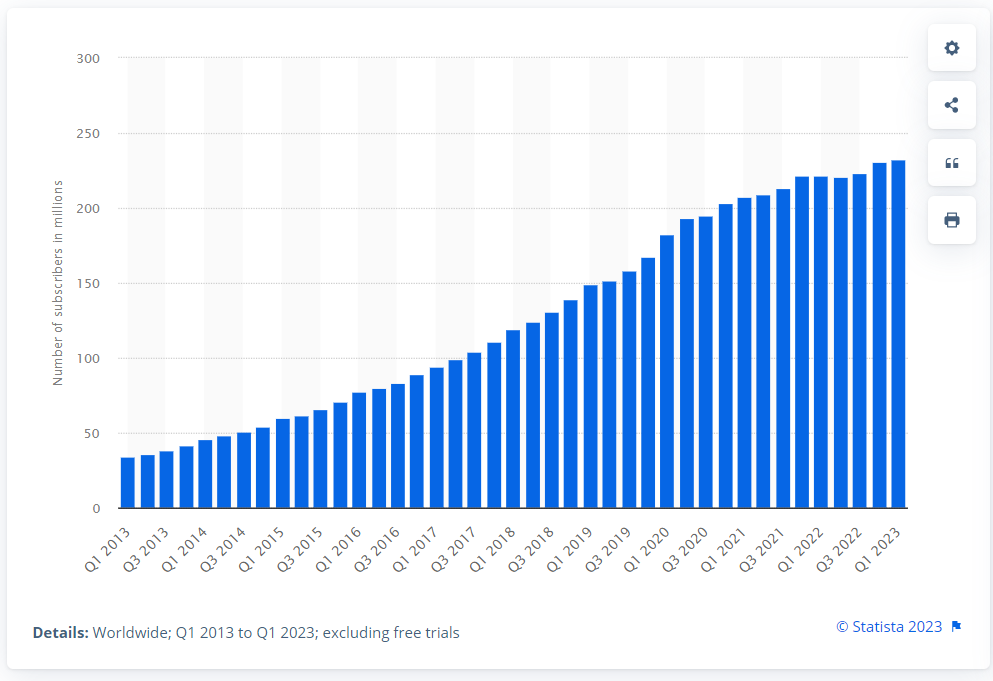

As a second source of pressure, subscriber growth went negative for the first time last year, with a small decline in the number of users signed up for Netflix’s service. For a company (and a set of shareholders) used to unlimited subscriber growth, this stat was hugely concerning. Here’s a graph where you can see that growth slipping:

Response

Netflix was the only game in town, but now they aren’t. Things are getting difficult. Analysts are saying the stock is over-valued. How would you respond as CEO?

New Leadership

Obviously, you start by stepping up into the Chairman position, leaving the difficult CEO work to someone else. I’m kidding, but that is what former co-CEO Reed Hastings did earlier this year. Now, he’s left his old co-CEO, Ted Sarandos, with a new co-pilot, Greg Peters.

Sarandos is the content guy, who helped Netflix ink partnerships with studios. He’s also been driving Netflix originals, leveraging his relationships with Hollywood veterans to create content in-house. Peters, on the other hand, acts as the product-centric innovator that Hastings was before. Peters led the company’s move to introduce an advertising tier, which I’ll cover in the next section. He’s also led international expansion, which has paid off in spades. Here’s their subscriber base by region:

Yes, you read that right. They are bigger in EMEA than in North America. It’s also worth saying that this new duo isn’t new to Netflix. Sarandos has been there since 2000, and Peters since 2008. And as Sarandos said in a recent statement, this transfer of leadership has been in the works for a long time –

“Typical of Reed, this is something that's been on his mind for a long time, more than 10 years. That's why you saw, in a very informal way, him pulling myself and Greg into things that weren't even necessarily in our bailiwick, and then formalizing it two and a half years ago with me co-CEO and Greg as COO, and then starting to delegate more and more of the day to day.”

This is from a great interview Bloomberg did with Sarandos and Peters – you can find the full interview here.

I think this leadership transition is a great decision. It offers continuity with Hastings still available to advise from the board, and Peters and Sarandos both having grown up at Netflix. It also signals that the things Peters and Sarandos have spearheaded at Netflix – partnerships, original programming, international expansion, and product innovation – are important to its next chapter. I think these are the right things to focus on. Finally, it just raises my respect for Reed Hastings from a 10/10 to a 12/10. It takes a special kind of leader to choose successors, empower vs. undermine them, and permanently hand over the reins. Bob Iger at Disney and Marc Benioff at Salesforce have struggled to do the same.

Adding Ads

The second strategy Netflix has taken is to launch a new product – an ad-supported tier. Critics argued Netflix was eroding a key benefit, the ability to binge content ad-free, but Netflix wanted to attract new customers with cheaper plans. This ad-supported tier – at $6.99 per month instead of the $15.50 for a typical plan – lets price sensitive customers enjoy the same content for less. And it’s only four minutes of ads per hour. Customer uptake was slow when it first launched in November 2022, and Netflix actually had to return some money to advertisers for missing viewership projections. But per their most recent earnings call, things are back on track. They are hitting their viewership projections, 19% of new subscribers are choosing the ad-supported tier, and 1.7% of Netflix’s ~75M US subscribers are on that new tier. This helped Netflix reverse the subscriber slump, adding 1.7M subscribers in Q1 2023. Even if they actually end up cannibalizing their existing subscriber base a bit along the way, it’s actually a good thing. Netflix says they make more from each ad-tier subscriber than from the standard plan subscribers.

As a second prong to this new product launch, they are also planning to crack down on password sharing. They’ve been messaging this for almost a year. They estimate there are 100M+ households that watch Netflix but don’t pay. Netflix will start doing monthly verification on shared devices, and it will prompt the main account holder with the choice to pay extra for extra users or push freeloaders off in one step. In my mind, it’s perfectly logical to build a possible landing pad – the ad-supported tier – before you start the crackdown. This maximizes the chance of adding new subscribers when you begin enforcing the new rules.

Do Live Sports (note: pure speculation)

As a final part of their competitive response, I think Netflix will finally lean into live programming – especially sports. Netflix execs have always shot down live sports when asked publicly. As recently as December 2022, Ted Sarandos was quoted as saying “We’ve not seen a profit path to renting big sports.” But hear me out:

Yes, “big sports” might be overbid and not financially attractive, but there are hundreds of smaller sports leagues, and thousands of smaller teams with cheaper distribution rights. And according to Netflix insiders (as reported by Deadline), they have already been quietly exploring bids for smaller sports leagues.

Netflix has also already started testing their technical capabilities for live events, including a recent live reunion for its hit show “Love is Blind”. This testing matters – live and on-demand streaming are very technically different. With on-demand, you can take shortcuts to improve the viewing experience – like storing a copy of popular content closer to the user. With live, you have to be ready for a large set of users watching something unrecorded/uncopied, simultaneously.

Netflix is (recently) awesome at telling sports stories. They’ve already gotten Americans to care about Formula 1 with their hit show “Drive to Survive” (approved for a season 6), and they’ve reignited a love of golf with their new show “Full Swing”. If they can acquire the rights to smaller sports and leagues, and then use their storytelling to generate hype and increase viewership, then getting serious about sports is a win-win.

Peacock, Hulu, and other competitors were first to launch ad-supported tiers, and Amazon Prime was first to sign a big live sports deal (Thursday night NFL football – an 11 year contract worth $11B). Since Netflix is finally adopting logical competitor features like ad-supported tiers, they should absolutely take a hard look at live sports.

Wrapping Up

I think Netflix is doing all the right things, and that naysayers will be wrong yet again, at least in the short term. But as I mentioned at the beginning, history says that at some point the naysayers will be right. No company lasts forever. Netflix joined the S&P 500 in 2010, so they’ve been there nearly 13 years. If they make all the right moves now (including live sports!), I think they buy themselves at least another 3-4 years near the top. But will they make it to 2030, beating the average 20-year lifespan for S&P 500 companies? That’s harder to say yes to, but I’m excited to watch. Pun intended.