Down. Bad. (Tesla's Version)

What's wrong, and turnaround strategies

Hey people! Welcome back to Forests Over Trees, your weekly tech strategy newsletter. It’s time to zoom-out, connect dots, and (try to) predict the future.

If you enjoy this post, please feel free to like and share. Thank you!

And just before we get to the main event, a big thank you to this week’s partner, House of Leadership. Be sure to show them some love.

House of Leadership (link)

Join 7300+ tech leaders leveling up their skills and becoming great leaders.

Down. Bad. (Tesla's Version)

Our mission today, should we choose to accept it, is to help Tesla.

Let’s start with a briefing on what’s been happening.

The situation at Tesla

Employee sentiment is low

They announced a 10% layoff just before Q1 earnings. They hoped it would send a positive signal to investors because…

The stock is down 30%+ this year

Tesla is always a bit of a rollercoaster for equity holders, but now we’re on one of those steep drops, and people are freaking-out

… And the stock is down because…

The numbers look pretty bad

Revenues for the first quarter are down 9% from last year. Vehicle inventory nearly doubled because of slowing sales. Profits are down 55%.

But of course Elon isn’t just sitting still and taking the beating – he’s already tried a few things.

What’s already been done

Cutting operational expenses

Revenues fell 13% and operating expenses fell an even greater 37%, so there’s obviously cost-cutting here (in addition to the recently announced, but not yet implemented, layoffs).

Doing ‘economist things’ to meet demand

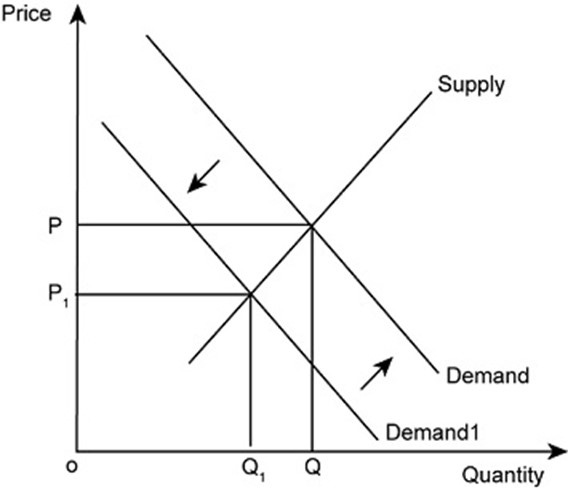

When demand is down, you slow down production and lower prices! If demand falls from ‘Demand’ to ‘Demand 1’ (fewer folks buying EVs), then at the current price level (P) you have too much supply (excess inventory). So you lower supply (cut production to Q1) and lower prices (to P1).

… and Tesla’s production slowdown and price cuts have been all over the news, with the most popular model (Model Y) price dropped by more than 25%.

Telling a story about the future

They’re trying to get investors and customers excited about the future, dangling new revenue streams like robotaxi’s and actual robots (“Optimus” – strong name).

… Ok, wow. A lot to process there.

But that’s the situation and what they’ve done so far. Which leaves the question – what can they really do next?

Turnaround Time

Here are a few opportunities, including some they’re already working on. And I’ve numbered these just to keep things organized, but this is by no means in priority order.

Idea #1 – Keep the licensing mojo going

Recently, competitors like ChargePoint passed Telsa for the total number of charging ports. But not for fast charging! Tesla’s Superchargers are still 60% of the market.

And last year, Tesla pulled a crazy move. They announced they would let other carmakers pay to use Tesla’s charging network. I covered it last June in the context of Rivian’s battle with Tesla. Here’s a blurb from that piece:

Piper Sandler (investment bank) estimates that opening its charging network could add $5B in revenue per year for Tesla within 10 years. As former Tesla exec Jonathan McNeill put it: “This is a bit of an AWS moment for Tesla” — they’re bringing an internal advantage to the external market, and it could be huge.

Ok… we get it. Is there a new idea here?!

Here it is – keep going down that AWS path, turning cost centers into profit centers, by licensing out full-self-driving (FSD).

And yes, I know Elon hinted they are “in talks with a ‘major’ carmaker” to do this, but my pitch is pretty specific – do it for any price, and make sure you get to keep the data to improve the models.

If Tesla can get that first deal done:

Others will follow suit, with higher pricing

Negative PR around crashes / errors might go down, if it’s proven that on the whole, assisted drivers are safer drivers.

Tesla can be gathering a lot more data on road conditions and situation-handling, for improving FSD

That third point is the key. With only 5% of the US market, adding other car brands as data collectors would be huge for Tesla.

Idea #2 – Attack a different market

Instead of duking it out for scraps in the car market, or trying to fake it til you make it in autonomous vehicles, why not pick some other market that needs an EV overhaul?

The first example I thought of was to copy what Nuro and Starship are doing (small robots, one for streets and one for sidewalks, which can drive themselves and deliver stuff).

Like I wrote about when breaking-down Nuro’s strategy -- smaller vehicles bring an easier set of problems to solve, and I could honestly see Tesla dominating that market.

But that would require Elon swallowing his pride and building something small (and dare I say cute) rather than the tank-like Cybertruck, for example.

So then I settled on a different example. What about the industrial equipment space?

Nothing cute about that. Think forklifts, scissor lifts, and warehouse pickers. Electric versions of some of these already exist but could benefit from Tesla’s expertise. And if Tesla could bring batteries that last longer and charge faster, companies would pay up.

Idea #3 – Do Robotaxi’s, but add other sensors

Again, this one requires a bit of pride-swallowing for Elon, so maybe that should rule it out from day 1. But there has been even more talk recently about the failure of Tesla’s sensor strategy relative to competitors.

Here’s a reminder on the main sensor types:

Optical cameras are cheap and help cars recognize and classify objects

Thermal cameras augment detection of pedestrians and people

Lidar uses lasers to measure distances to objects

Radar does the same but with radio waves

Waymo uses all of them, and is in the lead, partnering with Uber and offering autonomous rideshare in Phoenix and LA. They are at level 4 of this taxonomy:

Level 0 – No Automation

Level 1 – Driver Assistance (ex. cruise control)

Level 2 – Partial Automation (vehicle drives in some conditions, with alert driver)

Level 3 – Conditional Automation (vehicle drives in most conditions)

Level 4 – High Automation (vehicle drives in all conditions in select environment)

Level 5 – Full Automation (vehicle drives in all conditions, everywhere!)

Meanwhile, Tesla is at level 2, forced to defend its camera-only approach.

And if he’s serious about catching Waymo and taxi-ing us around, he may need to bite the bullet and add other sensors, even if they’re expensive.

There would be significant model retraining, almost like starting from scratch, but he would have one secret weapon… his army of customers who already pay to test FSD.

There are ~800K paying autopilot/FSD customers. Let’s say 5% (40K) would test a sensored-out Tesla to help Elon. Waymo’s website says they have 20 million autonomous miles driven.

Even if Tesla needed 50 million miles to train in random environments (Waymo trained in specific cities/neighborhoods), that’s still only 1,250 miles per tester.

I drove that in 2-days from LA to Seattle, people!

It was horrible, and I would not recommend it, but it’s doable…

You get my point.

Tesla could claw-back to Waymo within a year or two if Elon were willing to walk this road.

Wrapping-up

If I were in charge, I’d be seriously considering #3 and starting to map-out what it looks like to change the sensor approach. This would materially move the needle on growth prospects. I think #2 is reasonable but unlikely, given that there are ego’s involved. Lastly, #1 is the most obvious first step (and just requires a deal to get started in that direction). But it’s probably not enough to completely reverse the negative narrative.

In any case, I’m sure we’ll see more twists and turns on this rollercoaster in the coming months. Hang on!

Bonus Bullets

Quote of the Week

I have had all of the disadvantages required for success.

— Larry Ellison, Co-Founder & CTO of Oracle

Quick News Reactions

FTC bans non-competes – I’m split on this. On the one hand, because the balance of power is with employers right now (layoffs, long hiring searches, etc.), I’m tempted to say this is all good. On the other hand, this could disincentivize innovation. It’s similar game theory to why patents on drug discoveries matter – the windfalls from monetizing those patents pay off the R&D and hard work needed to innovate.

Congress bans TikTok – Of course it’s not necessarily banned (it’s either banned or needs to be divested), but it will be incredibly interesting to watch this play out. There will be numerous suitors vying to buy it, lots of tit-for-tat escalations between China and the US, and the Supreme Court might even need to get involved. It’s like a tech version of the bachelor.

Meta RayBan’s adding AI – It’s a ‘banning’ trifecta in the bonus bullets this week! They announced they’re adding a voice assistant that uses multi-modal AI (what you’re seeing plus what you’re saying to give you smarter responses). I’m honestly loving this strategy by Meta. They’re putting out something that matches the form factor people expect AR to eventually be, and just making the tech as good as humanly possible within that form factor.

Overall Economy

This is the Weekly Economic Index published by the Dallas Fed. It’s made up of 10 different data sources from consumer to labor to production, and it’s designed to closely track US GDP.

Tech Equities & Bitcoin

The Nasdaq (blue) closely tracks tech equities, and I added the S&P 500 (green) and Bitcoin (orange) for comparison. Note: this is not investment advice, but it is interesting.

Tech Jobs Update

Layoffs Since COVID: (Source: Layoffs.FYI).