Storytelling is central to being human, and it’s how we’ve grown so powerful as a species. Our leaders are able to tell compelling stories, rallying us together to get things done. They paint a vision of the world that’s compelling and motivating. And most of our favorite stories – movies and books and shows – are about heroes and villains.

When you’re younger, those lines between hero and villain, good and evil, seem cleaner. I know what side I’m on when it comes to Harry vs. Voldemort, Batman vs. the Joker, and UNC vs. Duke (UNC, obviously.) But as life goes on, we are drawn to the stories about conflicted characters. That’s why shows like Game of Thrones and Succession are so popular. It takes time to figure out which characters we are rooting for. And the surprises – heroes doing bad or villains doing good – are what makes the shows worth watching.

This is supposed to be about crypto, so let me land the plane here… Sam Bankman-Fried (SBF) is definitely a hero-turned-villain in crypto. But the story of crypto (so far) doesn’t just have villains. No good stories do.

This article (and parts 2+3 in a few weeks) will be like the beginning of a heist movie, complete with corny nicknames worthy of Hollywood. It’ll be an intro to some important characters in crypto – the good, the bad, and the gray in-between. Today, let’s get “the bad” over with, and add some context.

SBF – The Millennial Madoff

Obviously, he’s done enormous damage to crypto. He co-mingled funds from his trading firm Alameda and his token exchange FTX, lost FTX customer deposits on bad Alameda trades, and dug himself a hole he couldn’t climb out of. Anyone would have trouble climbing out… it’s apparently $9B deep. He might have gotten away with it too, if it wasn’t for those pesky kids the enormous bear market (all risk-on equities, plus crypto, trading down). Instead, he’s on trial for one of the largest frauds in history, and he’s unleashed an avalanche of bad news and “contagion” into the rest of the space. Not to mention that he’s stirred up a hornets’ nest of negativity from the public and regulators.

Sam Bankman-Fried was born at Stanford (literally) to parents who were professors at the law school. He went to MIT and then to Jane Street to trade ETFs. After a few years there, he went way off the traditional finance path, spending a few months working at the Center for Effective Altruism in 2017. Its mission is basically to encourage people with means and brains to donate as much time and money as possible to benefit others. In SBF’s own words, “If what you’re trying to do is donate, you should make as much as you can and give as much as you can (Vox).” In his quest to do that, he founded Alameda, where Sam and his small team took investor money and used it to trade crypto.

After a few years running Alameda, he launched FTX in 2019, and it eventually became the third largest crypto exchange. Compared to other trading platforms like Robinhood with simple, gamified features, FTX was lauded as a platform for sophisticated traders. You could even trade derivatives and use leverage to make debt-powered trades.

Here’s a look at the UI of the platform – tell me that this doesn’t look complicated and cool.

Alameda primarily focused on arbitrage at first, including a Japan-US Bitcoin trade that netted $10+ million in 2018 alone. In investor pitches later that year, SBF advertised a forecasted return of 15-20%, which seemed quite modest by crypto standards. With his academic pedigree, ties to Wall Street, and early success, investors couldn’t wait to get in.

And when crypto prices bottomed in 2019 and started going back up, Alameda apparently shifted into much risker territory. They made big bets on prices, going long on Bitcoin and other smaller tokens. At the peak of the 2021 bull market in crypto, SBF’s net worth was $26B and FTX was bringing in $1B per year in revenue. Even on the way down in 2022, SBF appeared to be calm in the middle of the chaos, injecting hundreds of millions into bailouts of other crypto companies like Voyager Digital and Blockfi. He explained the acquisitions by saying:

“It’s not going to be good for anyone long-term, if we have real pain, if we have real blowouts. And it’s not fair for customers, it’s not going to be good for regulation (CNBC).”

Hero-type comment, am I right?

And on the regulation front, SBF was one of crypto’s fiercest and most effective advocates to lawmakers. He played the political game, donating to campaigns to get meetings. He educated congress and other influential players on what crypto was, why it mattered, and where the risks were.

Behind the scenes, a string of failed investments dried up his capital, and it wasn’t just investor money from Alameda. At some point, FTX customer deposits were thrown into the inferno too (without permission or notice). If you had an FTX account for buying and selling coins on your own, you’d still see your old balance, but it was just a number. The funds weren’t all there. Fast-forward four months, and he was making desperate calls to investors to help fill the hole.

As FTX was crashing down around him, he gave an interview to Vox where he came clean on a lot of things. In addition to having two choice words for regulators (think CeeLo Green), he was asked if the Effective Altruism pitch was basically a front? Was that just PR? His response: “It’s not true, not really…” He goes on to explain that he originally wanted to “win” and be seen as “clean” (hero), rather than win and be seen as “sketchy” (villain).

Those plans didn’t work out. Instead, he went to the dark side and lost.

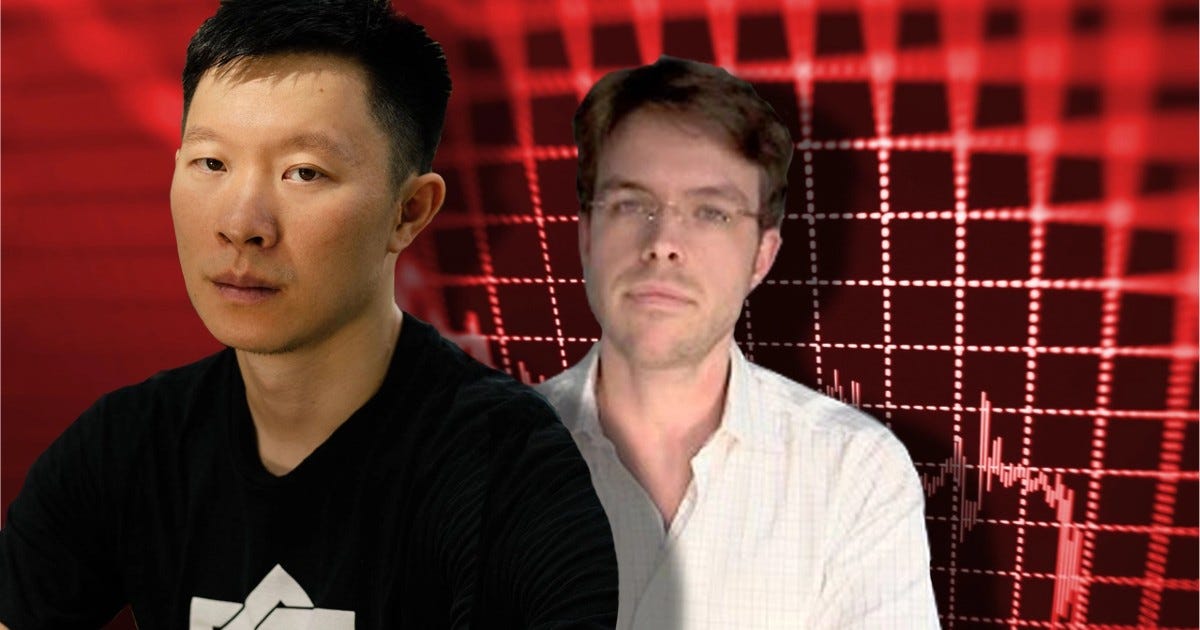

Kyle Davies and Su Zhu – The Disappearing Duo

Davies and Zhu happened to go to the same high school (Andover) and college (Columbia), but they didn’t meet until their first job. Starting in the late 2000’s, they traded derivatives together at Credit Suisse in Japan. After a few years, they started their own hedge fund, Three Arrows Capital (3AC), raising $1M from friends and family. They (allegedly) doubled their money after two months and moved to Singapore. Despite the early success, they struggled to keep good relationships with their customers – their former employer and the other big banks. They were arbitraging FX price differences from the banks, and eventually the banks cut them off, refusing to price their trades.

Looking for new territory, they found a home in crypto in late 2017. It was a massively lucky time to get into crypto… Here’s a graph of the price of Bitcoin…

When the price ran up, they looked like geniuses. They started borrowing money from investors at high interest rates (10%+), and somehow still delivered high returns. For those investors, 3AC didn’t always put up collateral, and they certainly didn’t have audited financials (nobody in crypto does… yet). At the peak they were managing ~$10B in assets, and then a string of bets blew up in their face. First, a huge position in a Bitcoin derivative went negative when the SEC rejected its application to be converted to an ETF in June 2021. Arbitrage opportunities dried up, the firm stopped hedging its downside risk, and they raised emergency financing from investors, levering up significantly. The majority of their assets were scattered across illiquid coins and VC investments. In response to margin calls and investor pressure, they went all-in on a new coin, Luna, started by their friend.

The friend was Do Kwan, a South Korean developer and Stanford dropout, and he’s an honorable mention for the “bad” section here. 3AC put in $200M, Luna went to $0, and Zhu, Davies, and Kwan disappeared later that month. There is speculation that some of the last loans to 3AC were from organized crime, and that’s why they ran. In any case, there are ~$3B in public creditor claims against them, including firms like Genesis, and former friends who put in their life savings during the final weeks. A $50M superyacht and a few mansions were orphaned in their wake.

Taken together, SBF and 3AC represent some of the worst that crypto has to offer, and they played a large part in exacerbating the bear market and destroying value. Deteriorating financial conditions revealed their fraud just like the proverbial “tide going out” that traditional financial markets talk about, but what can we learn from these latest cases?

Don’t associate with Stanford, even as a baby or a drop-out.

Now, in the bear market, is the perfect time to launch a crypto fund.

In all seriousness, I think the core lesson is something we’re already supposed to know. Unregulated markets, with high leverage and upside, can be dangerous. Now, I don’t blame regulators for failing to sufficiently regulate. Nor do I blame crypto companies for failing to sufficiently regulate themselves. Nor do I blame users and investors who wanted to be part of the upside. But each of the three will need to be involved in making serious changes if crypto hopes to exist sustainably.