Let’s play a game! Can you guess who today’s story centers on?

Hint #1 – he’s been in charge of Twitter.

Hint #2 – …but he’s been more successful as a payments company exec.

Hint #3 – …and he likes running multiple companies at once.

For once, it’s not Elon. It’s Jack Dorsey.

You might remember him from the virtual congressional hearings, where he was the cool, hippie CEO one Zoom box away from an anxious Mark Zuckerberg.

Jack is an eccentric, creative, billionaire CEO. He’s been a licensed massage therapist since 2002, and he was planning to be a fashion designer before Twitter (and later Square) took off. This is not normal behavior. Tech CEO’s do martial arts, threaten to fight each other, and wear leather jackets – they don’t train in stress-relief techniques.

And back in 2019… right before COVID hit… while still CEO of both Square and Twitter, he announced he would be working remotely… from Africa!

“OK. We get it – he’s eccentric,” I hear you saying… “who cares?”

Well, he’s betting big on something again, and it’s either awful or genius. We need to dig in and make sense of it.

So adjust your nose ring, stroke your beard thoughtfully, and let’s get Jack’d.

Making Moves

Block, the artist company formerly known as Square, will now make a crypto hardware wallet for $150. It’s available for pre-order now, and deliveries will start in March 2024 –

----WAIT! I can feel you itching to click away and immediately go buy one. After all, crypto is amazing and hardware wallets are a no brainer, right?

I’m kidding. But let’s start by understanding what hardware wallets are.

Hardware wallets primer

[Reminder: crypto currencies are like USD vs JPY, and crypto tokens are like the units of those currencies.]

Basically, hardware wallets are fancy, very secure thumb drives that store crypto tokens. And I would argue they exist for two reasons:

Crypto is still not mainstream, so the services that most people trust with their other assets (i.e. Venmo, Paypal, banks) are simply not as widely available or as frictionless as you would want.

Even if they were widely available, many crypto enthusiasts are super-duper security conscious and do not trust such services! Part of their reason for being enthusiastic about crypto is because they are so un-enthusiastic about the modern banking system.

To try to appeal to both those groups and keep everyone safe and happy in the wild west of crypto, hardware wallet companies spend a ton of time trying to balance:

A frictionless, intuitive experience (to maximize adoption, encourage more crypto trading, and earn more fees)

…with a hardcore, fortress-like storage system (to keep the security obsessed, libertarian-light crowd happy)

There is definitely demand for a product that can balance those two, but it’s not easy. So it begs the question… why is Block doing this?

Why do this?

Love

Well, I should start by saying that Jack likes bitcoin. In fact, he loves it. Here’s a quote from an April 2022 Bloomberg Interview:

“Bitcoin changes absolutely everything,” Dorsey stated matter-of-factly. “I don't think there's anything more important in my lifetime to work on.” (Source)

I happen to love ketchup, but you don’t see me claiming it “changes absolutely everything” and starting a company about it. So what else is going on here?

Pressure

Let’s look at their stock chart to get our bearings.

OK… that’s interesting. After digging into what was happening around the time the price fell off a cliff, it turns out 2021 was a year full of surprises:

Block’s price-earnings ratio hit 700, while the S&P average was in the 30’s

Jack bought the majority of Tidal from Jay-Z ($300M)

Jack bought Afterpay ($29B)

Afterpay, the buy-now-pay-later (BNPL) company, seems like a decent idea. Sure, BNPL doesn’t have a great reputation, but it is a good business, and apparently Afterpay had more international momentum to help Block diversify geographically. Tidal is so small that it shouldn’t really matter, although I think most people wrote off the streaming platform years prior.

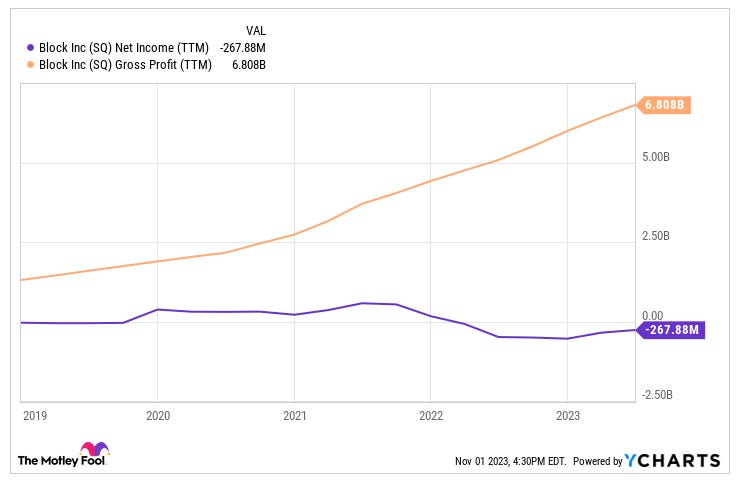

So why did investors get spooked? Despite growing revenue and gross profit, Block wasn’t growing net income, so they couldn’t do much to return capital to shareholders (via buybacks, dividends, or reinvestment). They weren’t being disciplined.

About a month ago, Jack started doing the equivalent of a hundred push-ups a day, trying to convince investors he was getting disciplined. He announced an “absolute cap” on headcount, he committed to $1B in share buybacks… and he opened pre-orders for a big bet on a new revenue stream – Bitkey.

Will Bitkey work?

Let’s get to the pros and cons of this new device:

Pros

Extension of Cash App and bitcoin businesses — A new revenue stream could create a flywheel effect, generating more revenue in multiple places. Jack is hoping folks already buying bitcoin on Cash App will buy the hardware and store their bitcoin there. Plus, Coinbase is a partner on the launch, so anyone using Coinbase to buy bitcoin could become a new hardware customer (and potentially even convert to buying the tokens on Cash App). And if you are using Cash App to buy your bitcoin, maybe you start using it instead of Venmo/Zelle to send cash to friends.

Leverages know-how from existing products – Block is not new to making small hardware… Square card readers are everywhere. Plus, Bitkey can be priced at an enormous premium compared to what the Square card readers are, because it’s a product where security and reliability are of the utmost importance.

Cons

Bitcoin only – as far as Jack is concerned, there’s only one cryptocurrency worth caring about. He’s what we call a “bitcoin maxi” (maximalist), and Bitkey won’t be able to store other currencies. But the best data I’ve been able to find says people who own some Bitcoin are only ~50% of the total number of people who own some crypto. Technically speaking, it would be simple to allow other currencies, but Jack is effectively cutting his potential user base in half.

Pricy suppliers – Because security is so important for a digital piggy bank, Block opted to manufacture on-shore, which means their cost of goods will be higher than they are used to with the card readers. For a company already under pressure because of weak net income, handing away potential profits right at the start of the production process is no bueno. They seem to be aware of this downside, and they even went so far as to write a whopping 1400+ words about it on their website. That’s longer than this whole Bitkey writeup! Imagine how pissed you’d be if I talked about their supply chain this whole time!

Hardware is eating the world? – Wait, no… that’s not what everyone has been saying the last 10 years… it’s that software is eating the world. The momentum of the world is headed towards digital, frictionless everything. In the long-term, I don’t think people will want to use physical hardware to store financial assets. It’s counter to the trend. Instead, I think new software/blockchain tools will evolve to meet the needs of the super security-conscious folks, while still being easy for the rest of us to use.

Wrapping Up

I’m going to go out on a limb here and say that I’m more crypto-positive than most of you…

…but even I don’t think this is a good idea. Too many things need to go right – new supply chains, picking the ‘right’ currency, hardware wallets win, etc…

But I’m willing to be wrong! Let’s keep an eye on how it goes and what else Block tries in the spirit of shaking things up.

Bonus Bullets

Quote of the Week:

Those who keep learning, will keep rising in life.

— Charlie Munger (RIP)

Quick News Reactions:

Netflix opens up about our bad habits — They are finally starting to publish reports every 6 months on the most popular shows/movies. For popular content, it summarizes hours watched, which countries are viewing, etc. It’s closer to “Spotify Wrapped” than a real report, but it’s a start.

Epic loss to Apple; Epic win against Google — The company behind Fortnite didn’t want to pay fees to the app stores, so they created a clever workaround, got booted off the app store, and went to court. They have been fighting this fight pretty much single-handedly… so hats off to them for the win. TBD what changes come out of it.

Subscription revenue… so hot right now — VMware is getting in on the action too. They put an end to expensive lifetime licenses in favor of cheaper subscriptions. So customers who shelled out for perpetual access are not happy.

Best of Threads:

Here are some awesome posts from my favorite Twitter replacement.

Tesla partners with Ford…for a tow

Tech Jobs Update:

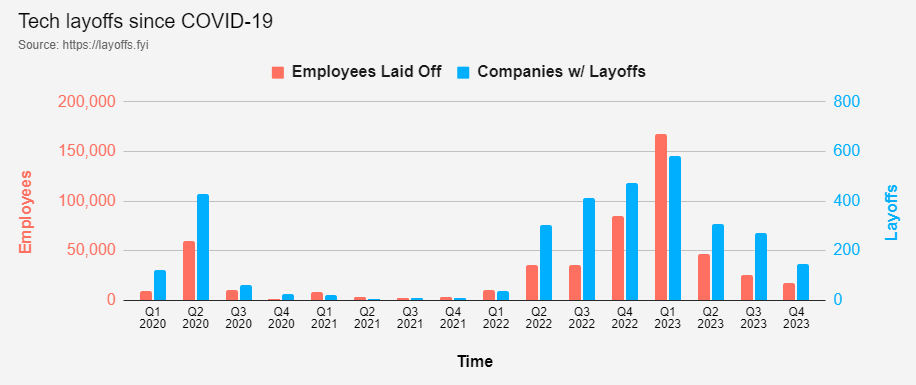

Here are a few things I’m paying attention to this week:

Big Tech Job Posts: LinkedIn has 5,335 (-32.1% WoW) US-based jobs for a group of 20 large firms (the ones I typically write about — Google, Apple, Netflix, etc.).

Graph: Layoffs since covid (Source: Layoffs.FYI). Note that this is showing in-progress numbers for the current quarter.