Tech Layoffs and Role Play

This week, we revisit tech layoffs, building on what I wrote back in January (link here). It’s an ongoing situation, but it’s the right time to check back in because:

We have new inflation and unemployment data

A few key companies just announced more layoffs

Integrating the new info will help us walk in the shoes of the Fed and of big tech companies. First, we’ll put on a suit, think stern thoughts, and pretend to be the Fed. Then, we’ll trade the suit for a hoodie, find some overpriced kombucha, and pretend to be a big tech exec.

Let’s do it.

The Fed

Last time I wrote about it, we used macroeconomics to analyze the layoff picture and predict when the bleeding might stop. So let’s refresh our memory and add some new data. Here’s a reminder about the Fed’s “dual mandate”:

The Fed is doing its job by raising rates, and it’s effectively reducing inflation. But this is only part of the Fed’s job. Their ‘dual-mandate’ means they’re responsible both for controlling inflation and maximizing employment. What’s crazy is that these two responsibilities are basically at odds with each other. Each cycle has two parts:

1) Raise rates -> spending goes down -> revenue slows -> layoffs…

2) Lower rates -> spending goes up -> revenue grows -> inflation…

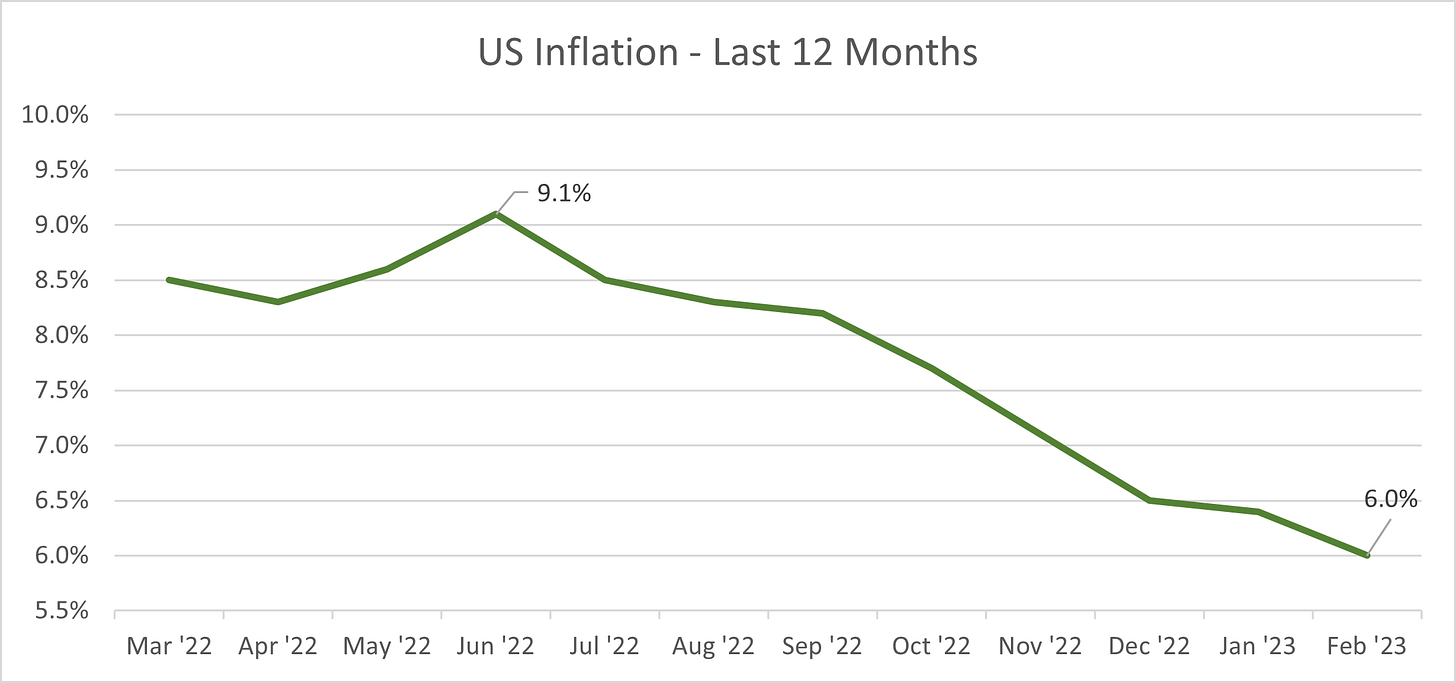

At the time, inflation was at 6.5% (Dec ‘22), down from a 9.1% peak (Jun ‘22). Since then, it’s continued to tick down to 6.0%… but at a slower pace.

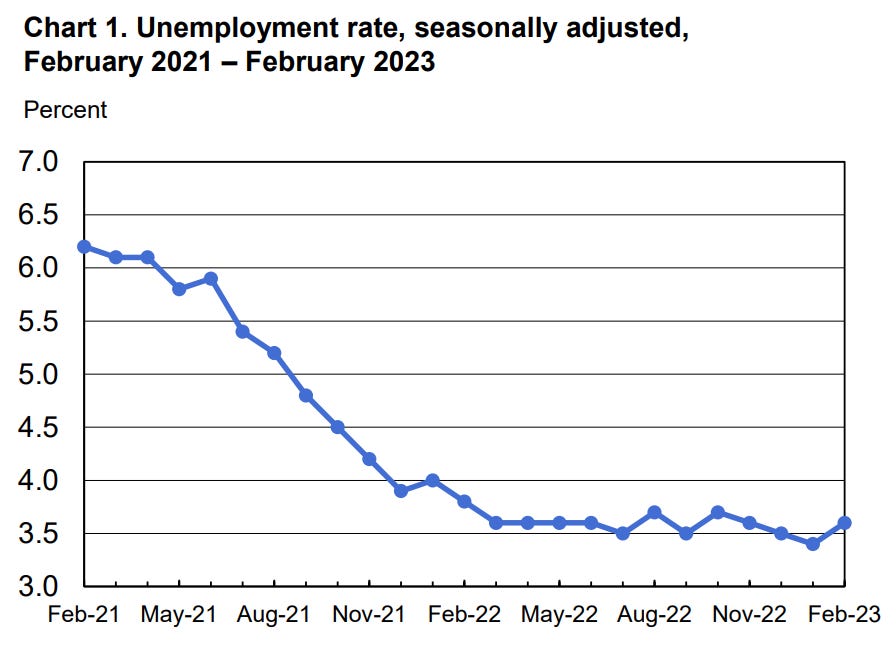

And how about unemployment? Here’s a graph from the St Louis Fed:

So essentially, inflation is coming down and unemployment is holding steady. And remember, unemployment spikes lag inflation spikes. So here was my prediction from last time:

For the last 8 recessions, the median unemployment peak comes 13 months after the peak in inflation. If the inflation reduction trend continues, our peak would have been at 9.1% in June 2022. Roughly speaking, using our 13-month rule-of-thumb, unemployment should peak near July 2023. We shouldn’t be surprised to see companies (tech or otherwise) announcing layoffs now and until that date, and they will likely slow down as we reach and pass that date.

Do you want the good news or the bad news first?

Good news

Inflation really did peak and is coming down. You are doing a great job being the Fed. Keep it up. It took 8 months to cut inflation from ~9% to 6%, so in another 8 months inflation might be nearer to 3%. While 3% inflation would still be above the Fed’s stated 2% inflation target, there would be a metaphorical light at the end of the tunnel. As a result, they will probably also stop raising rates soon. In fact, according to the Wall Street Journal, Fed officials said they only expect to raise rates one more time this year, by a small 0.25% -- the same size as the last few increases. Inflation is a lagging indicator, meaning that even when you stop raising rates, inflation should continue to come down.

Bad news

July feels really soon for an unemployment peak, especially since it hasn’t moved much yet. So my prediction above is probably wrong. Rather than July, December of this year feels more realistic. Therefore, we can expect layoffs, especially tech layoffs, to continue longer that we had hoped… to help explain my thinking, let’s now take the perspective of a big tech exec.

The Big Tech Exec

Tech firms are continuing to lay-off white-collar workers. Here are a few recent notable examples, courtesy of Layoffs.FYI:

Amazon: Said on March 20 they were cutting 9K jobs (3% of corporate workforce)

Meta: Said on March 14 they were cutting 10K jobs (12% of corporate workforce)

Zoom: Said on February 7 they were cutting 1.3K jobs (15% of corporate workforce)

PayPal: Said on January 31 they were cutting 2K jobs (7% of corporate workforce)

Before I get to the pesky “so what”, let’s do more perspective taking…

Imagine yourself in the role of a big tech exec trying to protect the company during an economic downturn. Obviously, you’d rather not fire people. It’s emotionally difficult (especially for them; but for you too). It hurts morale even for the people that stay, because they wonder if they’ll be next. It could even hurt the quality of your products and services, since there are fewer people around to put out fires (cough, Twitter).

Layoffs are also expensive.

Most firms pay severance, so it’s expensive to have fewer people working while your salary expense stays the same for a few months. But layoffs become even more expensive if the downturn is only temporary. Hiring and training new folks is more expensive than just retaining your current staff. And if you fire people too aggressively, you’ll kicking yourself if the economy roars back to life. Your competitors will laugh while they zoom past you.

For all those reasons, you first focus on reducing costs without firing people. You change policies for travel, make trainings remote, and stop giving out so much free food. This hurts morale too, but it’s a slower burn. When all those levers have been pulled, and you don’t see any light at the end of the tunnel, you start making selective cuts. Maybe you do cuts in one single layoff, perfectly sized based on how you think the company will perform a) during an economic downturn b) with fewer people c) who have lower morale. That sounds pretty difficult. Or maybe you ditch the single cut idea and do small cuts just-in-time, giving better visibility into the right level of cut, but hurting morale significantly more each time. That first cut might last you for a few months, but then you are back in the same position, struggling with whether to do more, and desperately continuing to search for other ways to get more cost out of the business. This is an art, not a science, and the stakes are high.

So let’s say you’ve already done several layoffs this way, morale is low, and your customers aren’t happy with the decline in quality. Every quarter, you meet with some internal economists at your firm, trying to understand what the Fed is doing, where inflation is headed, etc. During the last year, these have been horrible meetings, and then economists only give you bad news. Surprisingly though, today is different… they tell you they are seeing positive signs. They are expecting things to be dramatically better in 6 months. So then you ask your finance and strategy teams if you will survive 6 months without another layoff. They say yes.

Is there even the slightest chance that you would still proceed with firing people? In my opinion, no.

Enough! So what!?

Meta and Amazon aren’t seeing any light at the end of the tunnel… and they have the best possible vantage point for seeing the light. Meta owns Instagram and Facebook, so they probably know us better than we know ourselves and have a pulse on consumer sentiment. They also have 18% revenue market share for digital ads, giving them unique insight into business sentiment. And on the other hand, Amazon has reams of info about our shopping habits, spending levels, and preferences. And with Amazon’s AWS having 34% percent revenue market share in cloud services, they have thousands of other companies paying them and giving them signals about the direction things are going.

And with all that info, Meta and Amazon are making the decision to continue laying people off, when we know that it’s painful and costly for them to do so. For me, it’s a signal that they think the economy might get a little bit worse, possibly even falling into a recession.

Silver Linings

It’s a relief to see inflation coming down. There were some concerns that inflation might be more deeply entrenched, or that external factors (i.e. China reopening, Russia Invasion of Ukraine) might pump it above the 9.1% peak. But no such thing. The rate increases are working.

Companies like Meta and Amazon, although they are signaling concern, aren’t signaling panic. These latest cuts, while devastating to the people affected, are similar in size to past cuts they’ve made. Panic would probably look more drastic, with even larger cuts in this latest round.

Over the next few months, let’s hold these silver linings tight! We can also keep tabs on what the Fed does, and pay particular attention to what the largest companies (with the best vantage point) are seeing and doing. Until then, I’ll be looking forward to writing a future article celebrating how quickly things have turned around.