PayPal, BP, and Meta know but...change is hard

Think about something you’ve tried to change about yourself – a behavior, a habit, a thought pattern. What makes it hard? For me, it’s the fear of failure and the tradeoffs I have to make. It takes a combination of courage, stupidity, planning, and luck to make the change and stick to it. And it’s harder to change if I’ve been doing it the old way for a while.

How do you make change even harder? Add more people. Instead of your own small pile of fears and doubts, you now have a mountain of uncertainty and angst.

For businesses – whether they’re startups with 10 employees or incumbents with 10 thousand – it’s the same struggle to change. Today, we’ll walk through a few examples and evaluate how they’re doing. First, though, let’s look at a success story.

PayPal

Enter, PayPal. Founded in 1998 by Max Levchin, Peter Thiel, and Luke Nosek, they originally wanted to have a mobile device security company – and they named it Confinity. One of the products under that umbrella was a secure digital wallet that could “beam” money over the internet (note: if you just threw up in your mouth at the phrase “digital wallet” – relax, this isn’t a crypto article!). Luckily for Confinity, Ebay users thought that was a lot better than using checks and money orders, so they signed up in droves. That wallet product – PayPal – started to show a lot more promise than the security business, so in 2000, they made the formal decision to abandon the old business and the old name and embrace PayPal. Users were growing at 10% per day, they merged with Elon’s X.com, and in 2002 they IPO’d and immediately got purchased and taken private by Ebay. Just 2 years after fully abandoning Confinity, they had 15M PayPal users and a successful exit (two if you count the IPO and the take-private). Ridiculous.

It's hard to match PayPal’s trajectory, but there are tons of startup stories about pivots. When you are running out of money, searching for product market fit, and ready to jump on anything that works – that sense of urgency makes it easier to give up what you have in favor of what you might be able to get. Change is easier at that stage.

Late pivots are way harder, and those are the ones we’re going to go deep on today.

Before I do that though, let me put my (ex-)consultant hat on and offer a strategy-changing framework to help us dissect the moves. This is very similar to the actual steps your favorite consultants (take your pick, just don’t say Deloitte) recommend when working with the C-Suite at Fortune 500 clients.

Making Change – a Framework:

Identify the need to change. Sometimes there’s a catalyzing event, sometimes it’s just part of your normal multi-year planning process, or sometimes it’s a stroke of inspiration from one of your leaders. It can be in response to a problem, or in anticipation of an opportunity.

Design and build support for the change. Consider the options you have, and run qualitative and quantitative analyses on them. Bring your leaders in to help, and give them a sense of ownership. Deeply understand the pros and cons. Consider the tradeoffs, and make a decision.

Commit publicly. Tell the rest of the company. Let them ask the tough questions, and give them context on the decision. Explain how people at every level of the organization can be contributing to the change.

Follow through. Do the things you planned to do. There will be issues that come up that need to be addressed, so address them. There will be unexpected friction, people fighting the change, and many reasons to stop. But now is not the time to stop. Monitor the effect that your changes are having, and calmly and swiftly respond to the friction.

Reflect and iterate. After you’ve done what you set out to do, take stock of how it’s gone. What lessons can you learn for making big changes in the future? Do you see value in adjusting course to account for some of the criticisms? Do you have processes in place to maintain the benefits of the change, so you don’t slide back to a pre-transition state?

So that’s the framework. Let’s use it to look at two major pivots-in-progress. First up, an oil company pivoting into renewables (yeah… crazy right?).

BP

In February 2020, Bernard Looney took over as CEO, and he immediately started shaking shit up. He looked at long-term forecasts for oil and gas consumption – which included a shift away from fossil fuels as countries pursue net zero by 2050 – and he decided to go on offense instead of playing defense.

His first year as CEO, he identified the need to change, installed new leaders to help make it happen, and drove BP to announce their ambitions publicly:

By 2030:

Have 50GW of new renewable capacity (enough to power ~25M+ homes)

Dedicate at least 50% of capex spending to “transition growth engines” (renewables, electric charging infrastructure, and low carbon fuels)

Reduce fossil fuel production by 40% from 2019 levels

By 2050, be a net zero carbon emitter

Here’s a quote from Looney when he announced the shakeup:

“The world’s carbon budget is finite and running out fast; we need a rapid transition to net zero. We all want energy that is reliable and affordable, but that is no longer enough. It must also be cleaner. To deliver that, trillions of dollars will need to be invested in replumbing and rewiring the world’s energy system. It will require nothing short of reimagining energy as we know it…This will certainly be a challenge, but also a tremendous opportunity. It is clear to me, and to our stakeholders, that for BP to play our part and serve our purpose, we have to change. And we want to change – this is the right thing for the world and for BP.”

And he didn’t just set bold goals – he followed through. He cut the dividend to free up cash to invest in the required capex. He led BP to build 5.8GW of renewable capacity by the end of 2022. That same year, he put 30% of their capex ($4.9B!) into “transition growth engines”, making progress towards his goals.

But he encountered some serious pushback, especially from shareholders. The stock got hammered. Investors thought BP was leaving money on the table by not sinking more investments into oil and gas, and they weren’t happy to see dividends being cut in favor of longer-term plans.

At the same time, an energy crunch caused by the Russian invasion of Ukraine sent the price of oil sky-high, increasing pressure on BP and other oil companies to ramp up production. Over time, that pressure took its toll. According to recent reporting from the WSJ, BP and Looney are walking back some of their plans. They are increasing investments in fossil fuels, and they now plan to only cut 25% from 2019 levels by 2030 (in comparison to the planned 40%).

Reflection

Looney seems to have followed the framework step-by-step… until his resolve was tested in Steps 4 and 5. The follow-through hasn’t been as strong as it could be, and his iterating has been a bit of a reversal. I understand that balancing shareholder pressure and taking advantage of Ukraine related supply shocks is incredibly difficult. That said, there are climate-tech startups out there eager to take advantage of the momentum around green energy, capitalizing on subsidies (like those from the Inflation Reduction Act) that make “going green” extremely economically interesting. Like we discussed earlier, it’s easier for the startups to be nimble. The advantage BP has against them is a larger team with more resources, but it doesn’t matter how big your army is if you make them march in a different direction every day. BP hasn’t totally backed off of their transition-related investments, but right this second it feels more like a hedge or a nice narrative than a real “big bet”.

Meta

In October 2021, Mark Zuckerberg announced Facebook was now Meta. And he did a bunch of press about why. Basically, it boiled down to this – he’s excited about the metaverse, he wants Meta to be a pioneer in the space, and he envisions his company as more than just the single Facebook product (fair, since Meta also owns Instagram, WhatsApp, etc.).

In his own words, from a great Verge interview:

“For us, it was never just about social media, and increasingly we’re moving beyond that.”

And

“I think it’s helpful for people to have a relationship with a company that is different from the relationship with any specific one of the products, that can kind of supersede all of that.”

And

“We’ve had this conversation for several months now since I’ve signaled that I wanted us to become a metaverse company and be seen in this way. And I’d say, overall, the sentiment is definitely positive internally about it. I think more people are very excited about it.”

So Mark is explaining the reasons why, and internally, people are excited.

But investors hated it. Just like in the BP case, they thought Mark was leaving money on the table by neglecting his existing business. That business, as a reminder – is 3B users on Facebook globally, 2.4B on WhatsApp, and 2.4B on Instagram.

So look what happened to the stock after this October 2021 Meta announcement:

But wait, what made it go back up? Did Mark walk back his bet on the Metaverse? No, not at all.

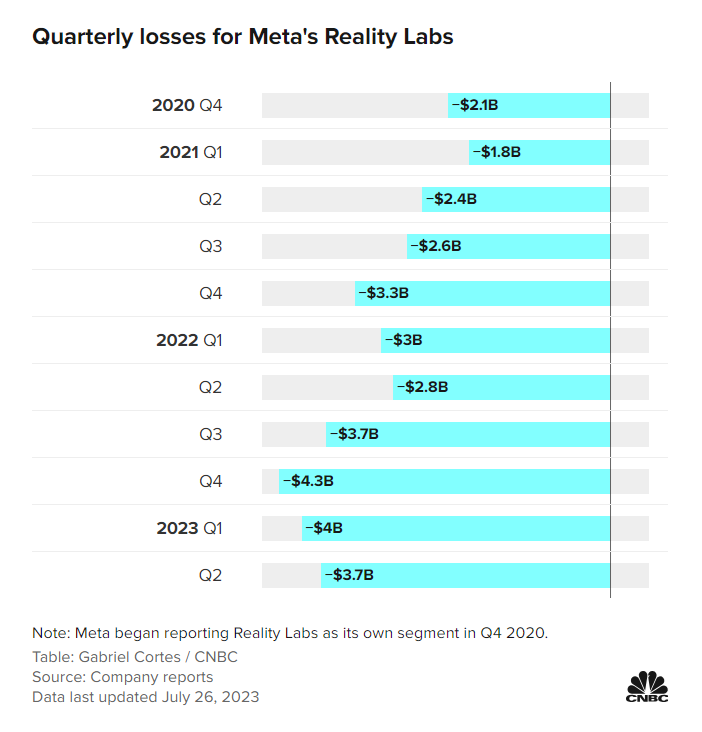

Actually, it looks like the quarter they sunk the most money into the metaverse via their Reality Labs business unit (Q4 ’22) is the same quarter their stock had one of its largest % gains. And in the most recent earnings, Meta said “for Reality Labs, we expect operating losses to increase meaningfully year-over-year.” So what changed then?

Two things primarily:

Layoffs: In November 2022 Meta laid off 11K people, and then another 10K in March this year. Cutting costs this way helped reinforce a message for investors that basically said Meta was being careful with where it spends money. It was part of what Zuckerberg has referred to as a “year of efficiency”.

AI: Throughout this ChatGPT-fueled AI wave, companies have stood out positively when they embrace, talk about, and invest in AI. During the last few earnings calls (even though Metaverse investments are still huge as shown above) Meta mentioned AI dozens of times while the metaverse hardly gets a mention. They are effectively riding the wave.

Despite the pressure from shareholders, Meta has been able to weather the storm of bad news and keep this long-term bet going. They’re even launching new Reality Labs products (announced an updated headset in June – great summary here by the Financial Times). Apple has their premium Vision Pro as I wrote about here, and Meta is aiming to be the affordable android-equivalent option.

Reflection

Meta followed the change management framework pretty closely too, and I would argue they’re doing a better job sticking to their guns. Mark built buy-in within the company before the announcement, he’s let his actions speak to his commitment after the initial announcement, and he hasn’t let loud naysayers distract him from his goal. Regardless of if you think the metaverse pivot is idiotic or brilliant, you have to admire the resolve.

Wrapping up

Alright… what’s the point of walking through that? I think there are a few things to learn from. First, it’s pretty obvious that Mike Tyson knows what he’s talking about when he says:

“Everyone has a plan until they get punched in the mouth.”

Frameworks and plans are nice, but they can only take you so far. Maybe part of their value is psychological – you know what the next step should be, so if you can turn down the volume on the criticisms, you can push through the hard moments and get to the other side.

But the second and most important learning for me is about how you respond to the critics. If they criticize you for walking down a particular path, you don’t have to use that same path to backpedal your way out. You can plan other creative ways to appease the critics, maybe choose a slightly different direction, and keep marching forward.

Bonus Bullets

Quote of the Week:

“I’m 56 now and… YESTERDAY I was 20. You know what I mean? And today I’m 56. Time flies... And I think one day, you will regret it if you don’t reach what you can reach. You should demand more from you. Not me demanding more from you. Not me… I think you should demand more from you.”

— Jose Mourinho, Legendary Soccer Coach

Quick News Reactions:

DARPA Challenges are back, baby: The newest one is the AI Cyber Challenge, and it’s designed to help generate defenses to AI attacks. The winners will walk away with $20M. Good things happen when the US government seeds innovation.

Chinese internet companies are stockpiling Nvidia chips: They just ordered $5B worth, anticipating that exports might get closed down. Nvidia just can’t seem to catch a break this year (kidding!)

Paypal is launching a stablecoin: This isn’t designed to be a volatile crypto asset since it’s pegged to the US dollar. If the US Government is looking into stablecoins too (which they are), and the existing market is crowded (it is), then this makes no sense to me (yet).