Hey people! Welcome back to Forests Over Trees, your weekly tech strategy newsletter. It’s time to zoom-out, connect dots, and (try to) predict the future.

And just before we get to the main event, a big thank you to this week’s partner, The TakeOff.

Created for Silicon Valley founders, investors and professionals, The TakeOff analyzes emerging market trends, venture capital flow and actionable insights. It’s a free newsletter read by founders and professionals working at Google, a16z, OpenAI and more.

Sign-up here to get ahead.

Japan + Chips = Full Bloom

In my first semiconductor deep dive back in March 2023, I talked about the entire supply chain – from the modern day Picasso’s designing chips, to the chemicals poured into them, to the advanced machines required to assemble them.

And the key takeaway, at least at the time, was that every player in that chain has a mantra – stay in your lane!

“To make the best chips, you need US designs, Japanese materials, Dutch equipment, and Taiwanese manufacturing, which is ultimately packaged and sold as an Apple chip.” (link to that post)

Japan is trying to change that.

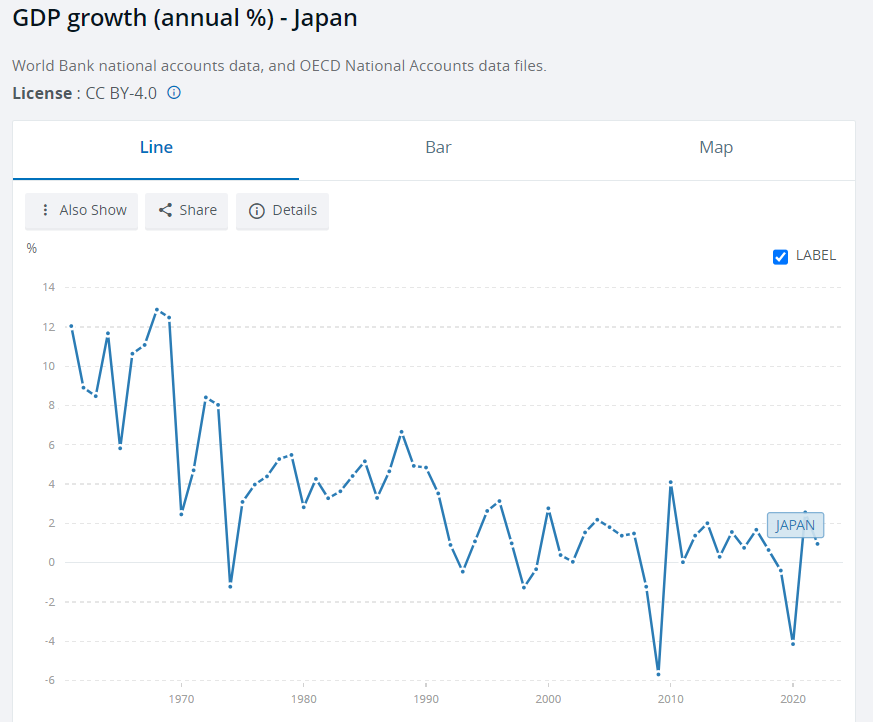

They want to grow into a bigger role and reverse their recent economic slump in the process.

So growth through chips is their goal. How are they doing it?

Moving fast and creating win-wins for partners.

In 2021, TSMC announced a deal to build a $7B new fab in Japan, one of the first to be built outside Taiwan since 2018 (others are planned for Germany, the US). To keep things moving, Japan:

Showered them in subsidies, including a $4.9B payday for agreeing to a 2nd Japanese fab

Agreed to only produce less-advanced chips in the new TSMC Japan fabs (so bleeding edge chips are still only made in Taiwan)

Invited TSMC to bring as many high-skilled workers as needed to fast-track the construction and adhere to the company’s quality standards

More recently, in February 2024, Japan announced a $1.9B subsidy to foreign chip-makers Western Digital and Kioxia to expand their production plans in Japan. Those two focus on memory chips, which are the go-to type for efficient large language model storage.

Then in April, they announced a $3.9B subsidy to the home-grown chip-maker Rapidus to try to catch TSMC and build 2nm chips by 2027!

Need I go on!?

On top of those investments, the things they aren’t doing also speak volumes.

Specifically? Regulation. They aren’t banning ChatGPT (cough, Italy). And they are going relatively “soft” in defining AI rules as explained by the Washington Post here, allowing companies and industries to experiment.

But back to the economic problem… why start with chips?

Chip investment creates a chain reaction.

Investing in chips makes you more critical to the chips supply chain, so you capture more of that value.

Being more critical to the chips supply chain means heavy consumers of chips want to be close to you and build offices/manufacturing in Japan (i.e. cloud providers, electronics manufacturers, etc). Why? Proximity brings down costs and makes deal-making easier.

AI companies want to build capabilities close to the cloud providers running their training and inference (for the same proximity reasons), and AI innovation drives productivity growth.

Bringing all that work and activity in (from steps 1,2, and 3) will attract other industries to service them.

The boost in productivity (#3) and activity (#4) drives GDP growth

Brad Smith of Microsoft was even quoted as saying:

“The competitiveness of every part of the Japanese economy [depends] on the adoption of AI….[AI is essential to] sustain productivity growth, even when a country has a declining population."

Ok… you’ve heard it from me and now you’ve heard it from Brad. You get it.

One other point to make here is that the cycle above can become a flywheel! If you have GDP growth, you can invest in more subsidies to continue leading in R&D, etc.

So… is the flywheel up and running?

You’re damned right it is!

The plan is working.

After committing to $26B in subsidies to revive their chip industry and grow out of their role as just “the materials provider”, good things are starting to happen.

I’ve already mentioned the partnership with TSMC, but there’s at least a few more marquee names on the bingo card…

What about Nvidia?

Yes! In March, Japan announced a partnership with them to design the chips for a joint project to build a quantum super-computer.

What about OpenAI?

Yep. A few weeks ago, OpenAI announced that their first office in Asia will go to Tokyo. At the same time, they teased a GPT-4 model specifically catered to the Japanese language.

Microsoft?

Yeah. They’ll invest $2.9B in new datacenters for their Azure cloud offering.

Wowsa. Google?

Yes, a measly $1B to run more fiber optic cables under the ocean from the US to Japan.

And even though it’s only been a few years since the money and partnerships started flowing in, there are encouraging signs of GDP growth downstream…

From a separate $15B datacenter investment by AWS (my employer for whom I do not speak!), Japan is expecting a ~$37.6B bump in GDP and 30K+ new jobs.

And from the TSMC fabs we talked about earlier, wages for workers in the area are already ~30% higher than before, which should drive consumer spending/demand that lifts GDP.

Wrapping up

Lastly, it’s worth taking a second to compare Japan to the US in terms of willingness to move fast. Remember how I said TSMC had agreed to non-Taiwanese fabs for Japan and the US?

As we now know, Japan compromised – inviting workers in, agreeing to produce older chips, and handing out money. The US… did not do those things.

As of March, the US hadn’t agreed to a dime in subsidies, was still arguing about the types of chips to make, and had unions stonewalling Taiwan’s efforts to bring in the workers required to keep quality and speed up.

So what? Japan’s fab will start producing chips later this year. And despite a 10-month head start, the US fab is only expected to start next year.

With how important chips are, and how quickly the AI and software on those chips is evolving, being 2 years slower than other countries is not good.

Bonus Bullets

Quote of the Week

“I look for people who don’t think they know all the answers, because no one does in this very fast-changing world.”

— Deborah Farrington, Co-Founder of StarVest Partners

Quick News Reactions

Mad (Robot) Max – It’s hard to believe, but autonomous 18-wheelers will apparently be on the road later this year in Texas, driving for the first time without human co-pilots. While the size of the trucks can make the physics of the self-driving problem harder (ex. have to “see” further to have enough stopping distance, etc.), the software/AI problem is slightly easier. It’s mostly highway driving and predictable routes.

Quid Pro Quo – This great Semafor piece talks about Apple dangling prime placement in their podcast player to any podcast creators willing to pay. It makes sense when you think about it in non-digital terms (ex. grocery store endcaps), but it’s still wild to see the lengths companies go to (and the things platforms will sell) to access consumers more effectively.

Not our first rodeo – UnitedHealth was testifying in Congress this week and confirmed that they paid $22M in ransom after being hacked due to lack of MFA. I heard the CEO also said roughly 1/3 of Americans’ data was impacted, and it shocked me at first. But honestly, we’ve had worse. The Equifax hack in 2017 impacted 40%+. When will we care enough to do enough to actually put a dent in these breaches?