AR Without Borders

Magic Leap deal likely a disappearing act

Magic Leap, which has been around since 2010, makes AR glasses. 2010, folks. When you think you’re tired of the hype around AR not matching the reality, imagine how they feel. But that’s not what piqued my curiosity today. It’s because of a key investor.

Saudi Arabia’s Public Investment Fund (PIF) has been an investor since 2018, along with the usual suspects like A16Z and Kleiner Perkins, but the PIF went over 50% control in December. Since Magic Leap was founded in the US and has American leadership, it got me thinking about foreign ownership and how the US treats such companies. Familiar story, right?

My brain immediately goes to TikTok. Government concerns about its Chinese ownership haven’t resulted in any concrete changes yet, but some of those concerns seem valid. Does China have access to sensitive data? Could they use it in not very nice ways? Or is the bigger risk that they have device addiction protections in place, and we don’t?

Obviously, the circumstances aren’t identical. China competes globally with the US, and Saudi Arabia has traditionally been an important US ally (more on that later). TikTok was also launched in China first, and has had Chinese leadership from the start. The industries are different too. Software vs hardware – where physical products might be easier to track and control. But then again, there’s Huawei, another Chinese company, focused on networking equipment and cell phones.

In 2019, in the heat of the trade war with China and the much-hyped, so-far-underwhelming race for 5G supremacy, then-President Trump temporarily blocked US companies from doing business with Huawei. And the FCC under President Biden banned them again in November of 2022. In both cases, they cited national security concerns.

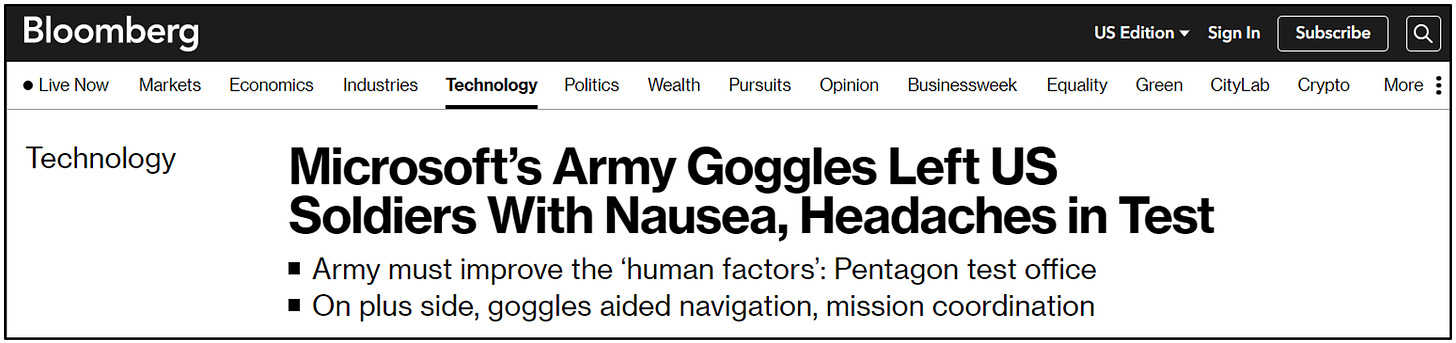

AR still needs to earn credibility with real world use cases and wider adoption, but the US Army is interested. And by interested, I mean they signed a 10-year, $22B contract to buy Hololens glasses from Microsoft. Sounds promising, but…

Even if early user testing by the Army has been rocky, this is good for AR, and might be bad for PIF and Magic Leap. When it comes to making a decision about how this impacts national security, if at all, things probably become difficult for the US. On the one hand, the tech itself is clearly playing in that lane. But on the other hand, are we just going to spell-out unique rules for each and every trading partner?

Basically – yes, we are.

Here’s a great article from The Washington Post that covers it in more detail, but the US and China each created ‘blacklists’ to block exports that are security concerns, detailing exactly what can or can’t be traded. And separate from that, the Committee on Foreign Investment in the United States (CFIUS) published its first set of guidelines via a Biden executive order in November. This comes after shooting from the hip – making decisions without a framework – for nearly 50 years since it was created in 1975. The guidelines all relate to national security, whether via protecting supply chains, citizen data, or key infrastructure.

So finally, we’re left with a tech product we know has national security implications, in a jurisdiction that has published rules saying “we care about that”, and whether it’s allowed really comes down to which country wants to do the buying.

It’s a good time to revisit the US-Saudi relationship I alluded to earlier. Which has essentially soured. The US still considers them an ally, but the human rights violations at the hands of MBS have made it difficult. And at almost the same time that Biden was telling CFIUS to put the pistols away and use a framework, MBS was meeting with President Xi Jinping in December last year to continue strengthening their partnership and formalize new trade agreements. According to Vox, China and Saudi Arabia are believed to have signed a $30B defense contract deal at that meeting.

I’m rooting for Magic Leap and AR more broadly, but from where I’m sitting, all of this sounds like enough for CFIUS to review and even block the deal. Let’s keep an eye on it to see what happens.