Adobe's Good Break-up

It was an ordinary Tuesday.

I was in Philadelphia on a consulting project, staying downtown. And I mean really downtown. I could hold my breath and walk the block from my hotel to City Hall, and in that same breath I could probably make it the additional half-block to my client’s office. I was a new manager on the team, and I was determined to have this project go well. Luckily, after months of grinding, we were finally making progress.

But actually, it wasn’t an ordinary Tuesday.

In our first meeting, the partner broke the news…

“The client got bought.

We are pencils down.”

I don’t know what you do for work. Maybe in your world “pencils down” is good thing, like you’re in pen sales just trying to make a dent on the pencil monopoly.

In my world, it was not a good thing. It effectively meant the project was over, and everything we had done up to that point probably wouldn’t matter. This was my second project in a row where the client got bought.

Why and how was this happening?

Well, when one company loves another company very much –

… I’m kidding. When a company gets bought, it’s smart to pause and re-consider everything you’re doing at the department level. Especially if what you’re doing is a multi-year effort to use AI to revolutionize accounting (no joke).

And the reason why pausing is smart boils down to psychology – you’re about to merge into a larger existing company, where you need to earn your spot, prove yourself to a potential new boss, etc. Now is not the time to bet the farm on a bold, long-term project.

What has any of this got to do with tech? Well, I’m not sure you’ve heard, but pencils are back up this week at Figma.

Meet the Couple

In September 2022, Adobe announced they were buying Figma for $20B, and this week they called it off. But before we discuss the change of plans, let’s refresh our memories on the bull case for this deal:

Figma was growing fast and profitably – recurring revenue was up 100% from the prior year, and gross profit margins were ~90%.

They had different strengths – Figma’s design tools were built to be collaborative (multiple users at once), consolidated (a single interface and tool), and easy to use, whereas Adobe had point solutions, built for experts, in a loose suite.

Figma had a small window of opportunity – 100% growth and 90% profit margins are extremely rare, especially when the Fed is fighting inflation and everyone is crying

wolfrecession. Going out on top made perfect sense.

So why did the deal get scrapped?

In a word: regulators.

Caving Under Pressure

The UK and EU announced they had issues with the deal on antitrust grounds, and the US DOJ was apparently studying it pretty closely. If that sounds vague and non-committal, that’s no accident. Rather than each of them weighing-in and listing out formal concerns and possible remedies, what regulators actually did was run out the clock.

The deal included a $1B termination fee paid to Figma if regulators rejected it or it took longer than 18 months to close. That sounds like plenty of time to have a thorough review in at least one of the three markets, right?

Wrong. The EU didn’t even start reviewing until August 2023… 11 months after the initial announcement. With time running short, and regulators being vague, Adobe and Figma couldn’t figure out a way through. Here’s a quote from Figma co-founder and CEO Dylan Field:

“It’s not the outcome we had hoped for, but despite thousands of hours spent with regulators around the world detailing differences between our businesses, our products, and the markets we serve, we no longer see a path toward regulatory approval of the deal,” (source)

With those facts in mind, let’s shift into opinions and predictions – why this matters and what happens next…

…For Adobe

It probably stings a bit to be told what you can and can’t do. It probably stings even more to pay out a $1B termination fee. But Adobe will be absolutely fine, because a lot has changed since September 2022. Here are two examples:

Before, they wanted Figma’s ease of use and collaborative features. Now, they are gaining traction with their easier to use Adobe Express web app, where users can comment and collaborate in real time.

Before, they worried about their broad product portfolio was too complex, with users and data scattered all over. Now, AI makes it easier to be a superuser – even for complex products. And AI models hungry for training data make all data more valuable. Riding that wave, Adobe launched Firefly – which plugs AI into all Adobe’s “Creative Cloud” apps.

…For Figma

Even though a billion in the bank is helpful, this puts a lot of strain on them. It’s difficult to shift from 100% growth mode, to pencils-down-defensive mode, and then back to growth mode at the flick of a switch. It will take some time to recover footing and resume innovating, but at least they have their founder still involved to help re-invigorate the team.

For Figma, just as with any smaller competitor, they need to win on:

Focus – don’t be tempted by Adobe’s breadth or get distracted from your primary value add. Your niche is your safe space.

Speed – AI is already underway, so be quick to push the latest advances through your products. But don’t stop there… keep your eyes up and spot the next wave.

…For Regulators

I am conflicted about this.

On the one hand, I don’t think it’s fair for regulators to play keep-away, stalling and killing deals indirectly. Why isn’t it fair? Because tech moves fast. In the moment, companies seem to move more slowly, and changes are hard to perceive, like seeing someone you work with every single day. But when you zoom-out, the tech industry changes incredibly fast – like when you come back from college and your brother is suddenly taller than you.

ChatGPT came out in November 2022, and that feels like a lifetime ago. The Figma deal was announced even earlier than that! Forcing the merging co’s (whether the deals get approved or not) to take a distracting, expensive time-out just doesn’t make sense.

On the other hand, I think that in this particular case, the end outcome actually feels fair and beneficial to consumers. And based on what feels fair, I guess in this case I side with the Brandesian’s, who I introduced in FTC 101. They argue that the consumer welfare standard (whether companies use monopoly power to directly raise prices or make inferior products) doesn’t cover the full scope of negative outcomes that can come from monopolistic behavior.

By preventing the deal, Adobe will (and should) absolutely compete with Figma in the future, and Figma might just be the upstart that disrupts Adobe. Figma has already been successful in forcing Adobe to simplify its products (cough, Adobe Express). This simplification gives consumers more, better choices, and it’s just one example of how encouraging competition can improve consumer outcomes.

Wrapping Up

Lastly, while it’s weird to think that international regulators have this much influence over whether two US-based firms merge… it also makes sense.

Most US tech companies are global today, and ignoring global regulators could mean having to: 1/ withdraw – missing out on revenue from that market or 2/ adopt multiple standards/processes depending on the market, which can explode costs. Either way, your profits get hurt, so firms are motivated to make peace with regulators all over the world. Plus, like we’ve talked about repeatedly, the US’ FTC and DOJ are struggling to bring and win cases, so maybe partnering internationally is a good thing. We get more bandwidth, and (idealistically) multiple voices to weigh in and arrive at fair outcomes.

Bonus Bullets

Quote of the Week:

“You should learn from your competitor, but never copy. Copy and you die.”

— Jack Ma

Quick News Reactions:

Sony’s PS5 outsold Microsoft’s Xbox 3:1 this year – that is a butt-kicking. But I think Microsoft can still very safely call 2023 a win (cough, AI!)

35.8M Xfinity customers had their data hacked – the hack was discovered in late October and they only reported on it this week… 57 days later. And here I thought only the hold times were slow!

WinterThe Vision Pro is coming – and reportedly will be in customer hands by February 2024. I’m really excited to see what this thing can do and how it raises the bar for mixed reality. More from my prior write up on the “Reality Wars” here.

Tech Jobs Update:

Here are a few things I’m paying attention to this week:

Big Tech Job Posts: LinkedIn has 9,261 (+73.4% WoW) US-based jobs for a group of 20 large firms (the ones I typically write about — Google, Apple, Netflix, etc.).

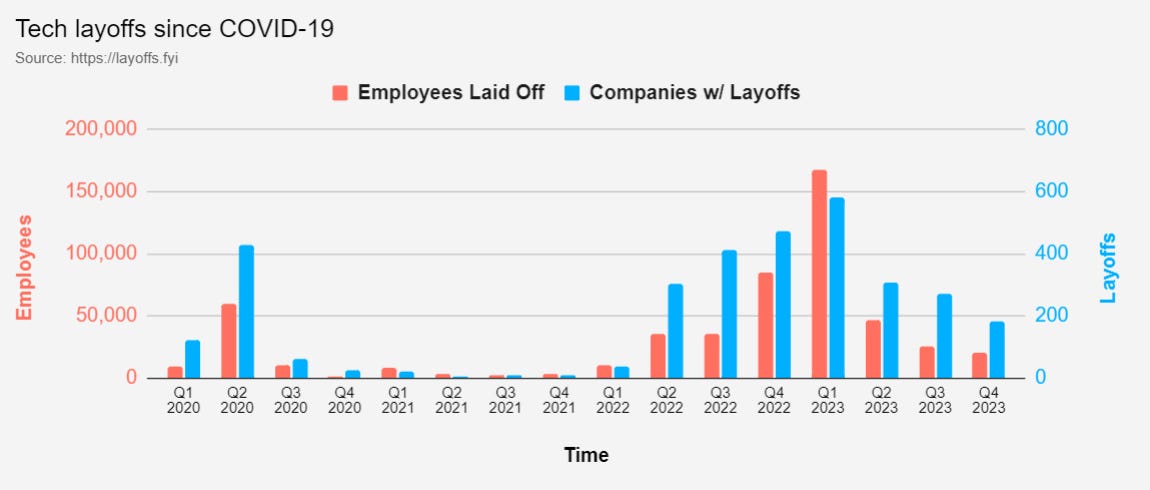

Graph: Layoffs since covid (Source: Layoffs.FYI). Note that this is showing in-progress numbers for the current quarter.