Have you heard of Chris Dixon?

He’s a VC. He sometimes blogs. And he gave me the perfect metaphor for today’s post.

In 2009, he wrote “Climbing the wrong hill”. I’ve caught myself climbing the wrong hill several times – in my career, in my relationships, etc.

Here’s the gist (my words, sorry Chris):

Imagine you get dropped somewhere you’ve never been. Your task? Find the highest point. You look around. There’s a hill. So you run to the top.

Damn! – there’s another hill a bit further away. And now that you’re up here, there’s no doubt. That’s a higher hill.

So you climb down. Then you charge towards the second hill. This time, you scan the horizon while you’re climbing up. On the way, you spot other hills. But this second one still seems like the tallest, so you keep going.

Finally, from the top of #2, you’re done with the task.

What Chris doesn’t say, but what seems obvious, is that the landscape changes over time. The task is never really “done”.

You need to keep your eyes peeled, because new hills are always rising up, and the one you’re on might fall.

Companies do this too. They are constantly scanning the horizon to look for higher hills. Don’t believe me? Ask Walmart.

Walmart’s Higher Hill(s)

After forty years of old-fashioned brick-and-mortar, Walmart opened their online store in 2000. After another nine years, they opened it to third party sellers. And in 2021, they launched their newest pursuit of a higher hill – Walmart Connect.

What is it?

Basically, Walmart Connect is Walmart’s ad-tech business. It gives advertisers the chance to show ads on the website, and even on in-store TVs… And Walmart doesn’t just pocket the revenue from running the ads. They make money if the ads work and you buy those products in the store!

This is big deal. And it’s definitely a higher hill.

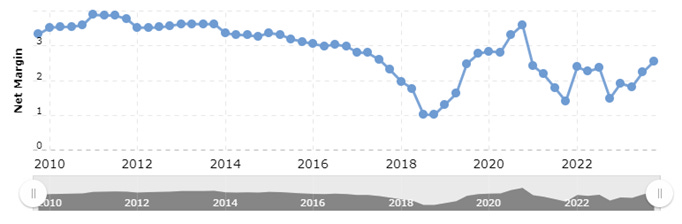

Right now, Walmart’s total revenues are huge (~$611B), but only growing about 5-6% per year. And the margins are thin. Razor thin.

Here’s a chart of net margin % since 2010:

Let’s compare that to Walmart Connect.

Revenues? $3.4B

Growth? 30% per year!

Margins? ~40%! (based on typical ad-platform estimates)

Even though Walmart Connect revenues are small (for now), margins and growth are so much higher, don’t you see—

--- Numbers blah blah blah – what’s the point?

My point… is that Walmart absolutely crushes it, but they are in a low margin, low growth industry. Busting out of that industry (and chasing higher hills like Walmart Connect) is critical to their growth trajectory.

And because it’s going well on this new hill so far, they will keep climbing… How do I know?

They are buying Vizio

The gadget geeks might already know, but the news dropped earlier this week.

Walmart is paying $2.3B, and while the deal still needs to get through regulatory approvals, I think they’ll be able to convince distracted, underfunded regulators that “these are not the droids you’re looking for.”

What I didn’t know when I first saw the news – but find fascinating – is that buying Vizio pushes Walmart Connect forward in 2 major ways:

Bigger supply of ad-space – They’ll be able to advertise to the 18M accounts that are now using Vizio TVs (and the associated “Smartcast OS”). For all those users, they can throw ads in exchange for free streaming (mirroring Netflix, Amazon Prime Video, etc.).

(Potentially) Reaching users that don’t shop at Walmart – Although 70% of Vizio TVs are sold by Walmart, the 30% that aren’t represent a huge opportunity. If they avoid pursuing exclusivity, they can let other retailers help them expand their ad supply. AND they can be driving Walmart shopping from non-shoppers (by paying discounted Walmart Connect fees to show Walmart ads on the Vizio TVs). Holy synergies Batman!

With those benefits in mind, I think this is a pretty smart play. But Walmart isn’t the first to do something like this.

Plays Being Called

I see a few parallels to things others have tried.

Controlling the hardware

I’ve written about this before, but companies want to get as close to the user as possible. Typically that means owning the hardware. As a backup, you can own the operating system and sit on the hardware. As a distant third, you can own apps and work within the operating system. Controlling the hardware gives Walmart options (Do we sell Vizio TVs outside our own stores? Do we build ad-supported streaming first, then do subscriptions? The possibilities are endless!)Embracing scalable revenues

To make revenue in the stores, you need to buy the land, build the store, fill it with shit, and convince people come shop. There are economies of scale (reduced overhead) as you get bigger and better at those things, but nothing compares to digital products (or ads). Digital scales better. Streamers > theaters. Ebay > yard sales.Responding to growth pressure

As Einstein taught us, “Insanity is doing the same thing over and over again and expecting different results.” The best – and perhaps the only – way to massively grow is to try new things. Trying new things might be one of the unifying themes of Forests Over Trees, because I’ve covered it in the context of AirBnb… and Meta… and TikTok… and Reddit...

So hat’s off to Walmart on what I think is a good play here. Looking forward to seeing which higher hills they charge up next.

Bonus Bullets

Quote of the Week

Just because you are the loudest, doesn’t make you right.

— Brian Halligan, Co-Founder of Hubspot

Quick News Reactions

The doc will

see youtalk to you now — Adobe is letting paid users jump into a beta and ‘converse” with their PDFs. This is clearly a repsonse to Microsoft’s Co-Pilot, but Adobe’s can’t yet draft new documents. To me, it seems they have some catching up to do.NSA needs fresh meat — The 34-year NSA Director of Cybersecurity is stepping down. In a year where we have our first presidential election in the age of AI, multiple global conflicts, and an unrelenting barrage of cyber attacks, this new director will have their hands full.

Klarna board fight — Michael Moritz used to lead Seqouia, but new Seqouia leadership tried to push him off the Klarna board (and then backed off). This is weird boardroom drama, but for me it also highlights how tough life in VC is right now. In boom times, I don’t think we would be hearing about this.

Overall Economy

This is the Weekly Economic Index published by the Dallas Fed. It’s made up of 10 different data sources from consumer to labor to production, and it’s designed to closely track US GDP.

Tech Equities & Bitcoin

The Nasdaq (blue) closely tracks tech equities, and I added the S&P 500 (green) and Bitcoin (orange) for comparison. Note: this is not investment advice, but it is interesting.

Tech Jobs Update

Here are a few things I’m paying attention to this week.

Big Tech Job Posts: LinkedIn has 6,588 (-15.8% WoW) US-based jobs for a group of 20 large firms (the ones I typically write about — Google, Apple, Netflix, etc.).

Layoffs from 2022-2024: (Source: Layoffs.FYI). Note that this is showing in-progress numbers for the current month.